Information on CIPFA's Competency Model

A competency model (framework) is a set of behaviours or skills that are essential for effective performance in an organisation and can be measured and observed.

The CIPFA Finance Competency Model comprises behavioural competencies, which are concerned with how we perform our roles, apply our technical knowledge, and meet our performance objectives.

The concept of competency reflects the evolution in the demand for ongoing professional development and the competency model is a tool that aids in this process of continual improvement.

Behavioural competencies provide the individual with an indication of the behaviours that are valued and recognised by the organisation.

How can the Competency Model help you?

The Model will help and enable you to identify the behaviours that drive successful performance and deliver services in a more effective way by focusing on a range of competencies that affect individual’s performance.

You can select which competencies are best suited to any given role and tailor the selection for your organisation.

This will help you establish a common ground around work practices and how staff are expected to behave in delivering the priorities set down in key corporate documents.

The Model can help you to undertake a whole range of people activities including assessing your overall resilience within the Finance team:

- Job profiling and restructuring of teams and organisations.

- Recruitment and selection (eg, competency-based interviews)

- Performance management

- Learning and career development

- Diagnostic – understanding why teams do/don’t work effectively.

How CIPFA can help?

Applying this Model will:

- Allow you to identify gaps within your organisation.

- Allow you to identify if employees are over/under skilled areas of the business.

- Enables you to have conversations at individual and team level.

- Help employees have a more focused development discussion and help employers to take charge of our own development and work more effectively with people across the organisation.

Get in touch

If you would like to find out more about how CIPFA can work with your organisation, please contact us to discuss how we help you with financial resilience.

Examples of our Competency Framework in use

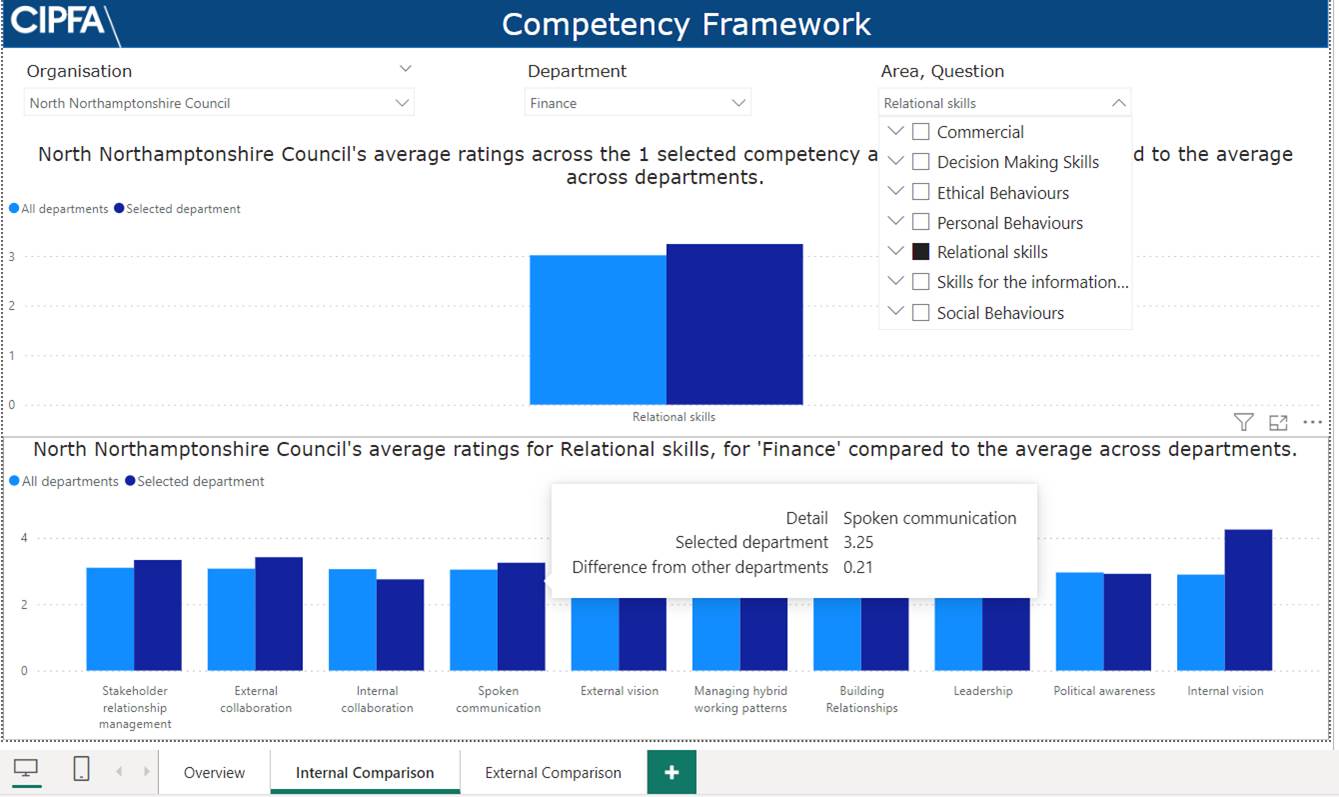

Example 1 shows that the City of London’s HR department has an average score of 2.8 out of 5, for the “Decision making skills” section. The graph shows this is below the overall average of 2.93 out of 5, but is similar to the result for the Home Office’s HR department.

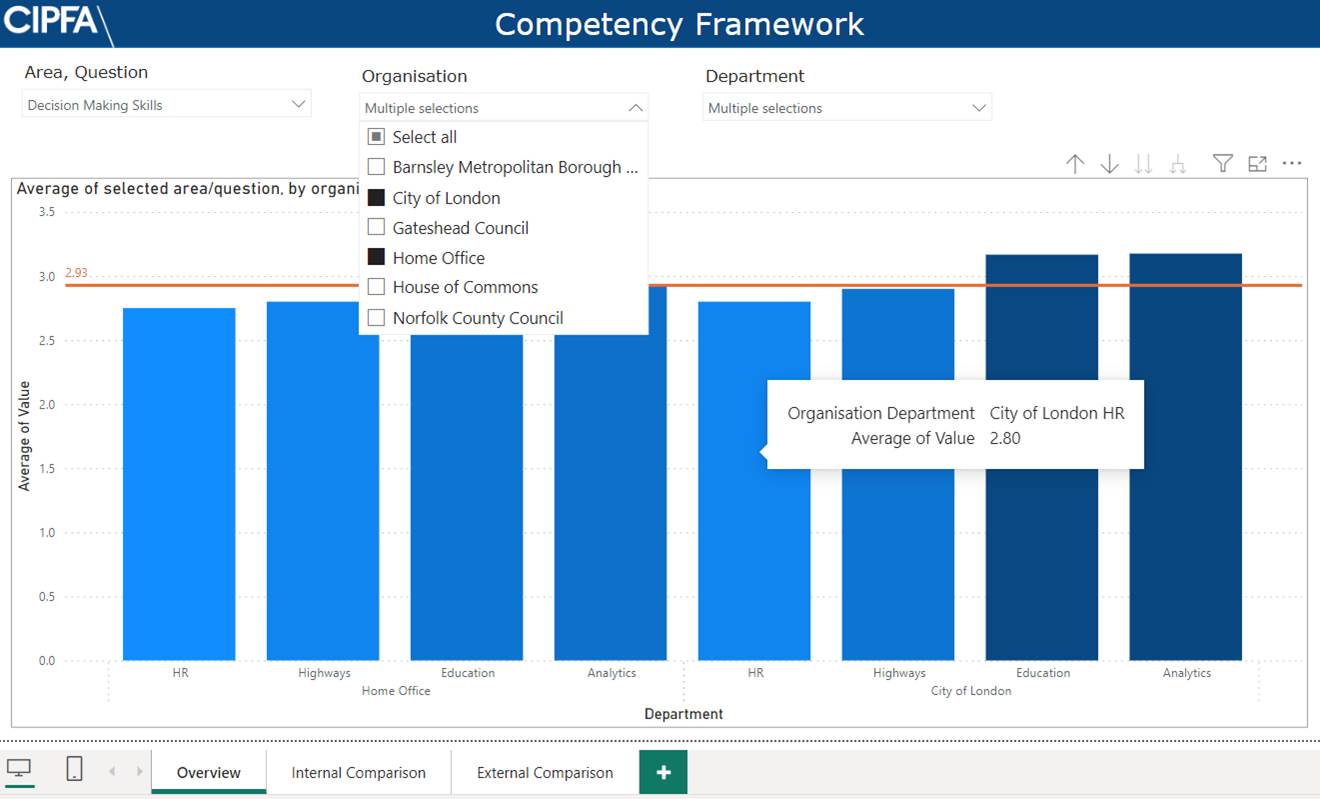

Example 2 shows each of the Competency Framework areas that can be broken down into their constituent questions. For this specific example there are 79 questions in total, split between 10 areas. This example shows questions in the “Relational skills” section for Finance, as indicated by the selections. By selecting the competency “Spoken communication”, we can see North Northamptonshire’s finance department scored 0.21 points higher than the average of 3.04 in all other departments within the council.